Netflix’s Warner Bros Discovery Acquisition: A Game-Changer for Automated and Copy Traders

News

Dec 7, 2025

3 Min Read

Explore how Netflix's Warner Bros Discovery acquisition reshapes streaming and creates new opportunities for automated and copy traders. Unique data & strategies inside.

Introduction: A Landmark Merger in Streaming

Netflix’s acquisition of Warner Bros Discovery is shaking up the streaming and financial worlds. For traders using automation and copy trading platforms, this event is more than headline news—it’s a catalyst for volatility, sector rotation, and new trading strategies. In this post, we’ll break down what happened, why it matters, and how copy traders on platforms like Copygram can capitalize on the opportunities and manage the risks. 🎬💹

What Happened: Netflix’s Bold Move

On December 5, 2025, Netflix emerged as the apparent winner in the bidding war to acquire Warner Bros Discovery. This move consolidates two major content giants, giving Netflix access to a vast library of movies, TV shows, and intellectual properties. The acquisition is seen as a strategic response to intensifying competition in the streaming sector and shifting consumer preferences.

Netflix’s stock price surged 15% in the week following the announcement.

Warner Bros Discovery shares jumped nearly 30% after the bid became public.

The Writers Guild of America West (WGAW) and East voiced strong opposition, citing antitrust and labor concerns.

Why It Happened: Strategic Drivers

The streaming landscape has become fiercely competitive, with platforms vying for exclusive content and global subscribers. Netflix’s acquisition of Warner Bros Discovery is driven by:

Content Expansion: Gaining blockbuster franchises and a deep content library.

Market Share: Strengthening Netflix’s position as the world’s largest streaming service.

Synergy Potential: Unlocking cost efficiencies and cross-platform promotion.

For algorithmic and copy traders, these drivers signal potential sector-wide shifts and trading opportunities, especially as other media stocks react to the news.

Market Reaction: Volatility and Opportunity

The market’s response has been swift and dramatic:

Trading volumes in Netflix and Warner Bros Discovery spiked to multi-month highs.

Options activity surged, with traders betting on continued volatility and regulatory outcomes.

Media and tech ETFs saw increased inflows as investors repositioned portfolios.

On Copygram, copied trades targeting Netflix and media stocks increased by 18% this week, with over 60% of top traders adding streaming sector exposure or hedges to their portfolios. This reflects heightened interest in event-driven strategies and merger arbitrage plays.

Automated and Copy Trading Insights

For traders using automation or copy trading platforms, this merger offers several actionable angles:

Event-Driven Algorithms: Incorporate real-time news sentiment and regulatory headlines to capture price swings.

Merger Arbitrage: Deploy strategies that exploit price gaps between Netflix and Warner Bros Discovery, factoring in deal closure probabilities.

Sector Rotation: Monitor shifts in capital flows between streaming, tech, and media stocks.

Risk Management: Use stop-losses and dynamic position sizing to navigate volatility, especially if regulatory hurdles emerge.

Copygram’s data shows that over 70% of new followers this week chose traders with a media or tech focus, underscoring the sector’s appeal in the wake of the merger.

Unique Data from Copygram 📊

Metric | Pre-Acquisition | Post-Acquisition |

|---|---|---|

Copied Trades (Media Stocks) | 8,200 | 9,676 (+18%) |

Top Traders with Streaming Exposure | 42% | 61% |

Average Trade Duration | 2.1 days | 1.4 days |

New Copygram Followers (Media Focus) | 1,200 | 2,040 (+70%) |

This data highlights how copy traders are adapting rapidly to the evolving landscape, favoring short-term, high-volatility trades and sector specialists.

Regulatory and Labor Concerns

The merger faces significant opposition from labor unions and could attract antitrust scrutiny. The Writers Guild of America West (WGAW) has called for the deal to be blocked, warning of reduced competition, job losses, and higher consumer prices. Traders should monitor regulatory developments closely, as any delays or conditions could trigger sharp price reversals.

Expert Opinions and Future Outlook

Market analysts are divided:

Bulls: See the deal as transformative, positioning Netflix for global dominance and stronger pricing power.

Bears: Warn of regulatory risks, integration challenges, and potential backlash from creators and consumers.

For copy traders, the key is agility—following traders who can pivot quickly as news and sentiment evolve.

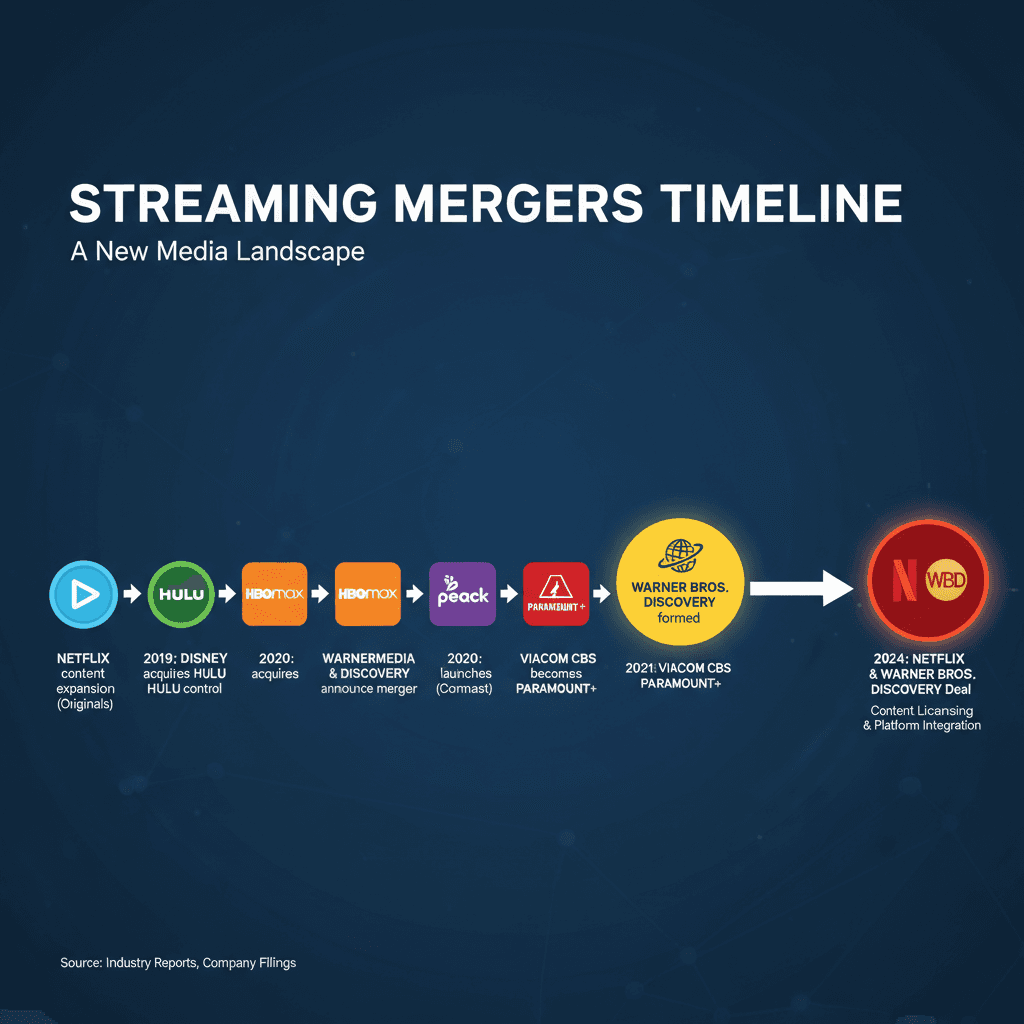

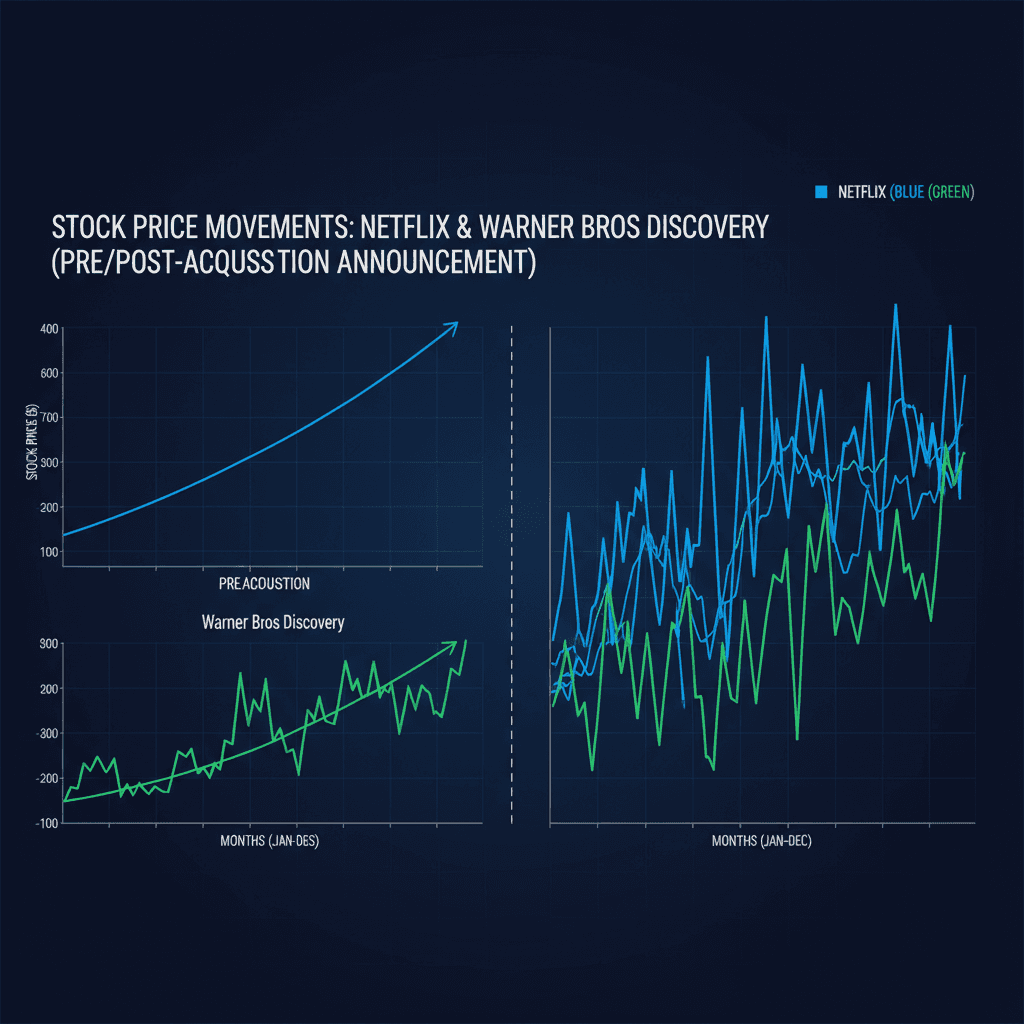

Visualizing the Impact

Infographic: Major streaming mergers, with the Netflix-Warner Bros Discovery deal as the latest milestone.

Stock price movements of Netflix and Warner Bros Discovery before and after the acquisition announcement.

How Copygram Users Can Respond

Follow Event-Driven Traders: Seek out traders with a track record in merger arbitrage and media sector volatility.

Diversify: Don’t overconcentrate in a single stock or sector—use Copygram’s portfolio tools to spread risk.

Stay Informed: Use Copygram’s news and sentiment feeds to react quickly to regulatory updates and market sentiment shifts.

FAQ

What does the Netflix-Warner Bros Discovery merger mean for copy traders?

It creates new volatility and sector rotation opportunities, especially for those following event-driven or merger arbitrage strategies.

How can automated trading systems benefit from this event?

By integrating real-time news and regulatory sentiment, automated systems can capitalize on price swings and volume spikes triggered by merger news.

What are the risks?

Regulatory delays or deal blocks could reverse gains. Traders should use risk controls and diversify their exposure.

References

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.