Indonesia's Nickel Ore Production Cut Triggers LME Nickel Rally: What It Means for Copy Traders

News

Dec 27, 2025

3 Min Read

Indonesia's nickel ore cut sparks LME price rally. Discover the impact, trading strategies, and unique insights for copy traders and automation platforms.

🇮🇩 Indonesia’s Nickel Ore Production Cut: The Full Story

Nickel is back in the spotlight as Indonesia—the world’s top nickel producer—announced plans to slash its ore production quota by up to 34% in 2026. The move sent LME nickel prices surging for a sixth straight session, shaking up global supply chains and creating a wave of volatility and opportunity for copy traders and automation platforms. Let’s break down what happened, why it matters, and how you can capitalize on this seismic shift. ⚡📈

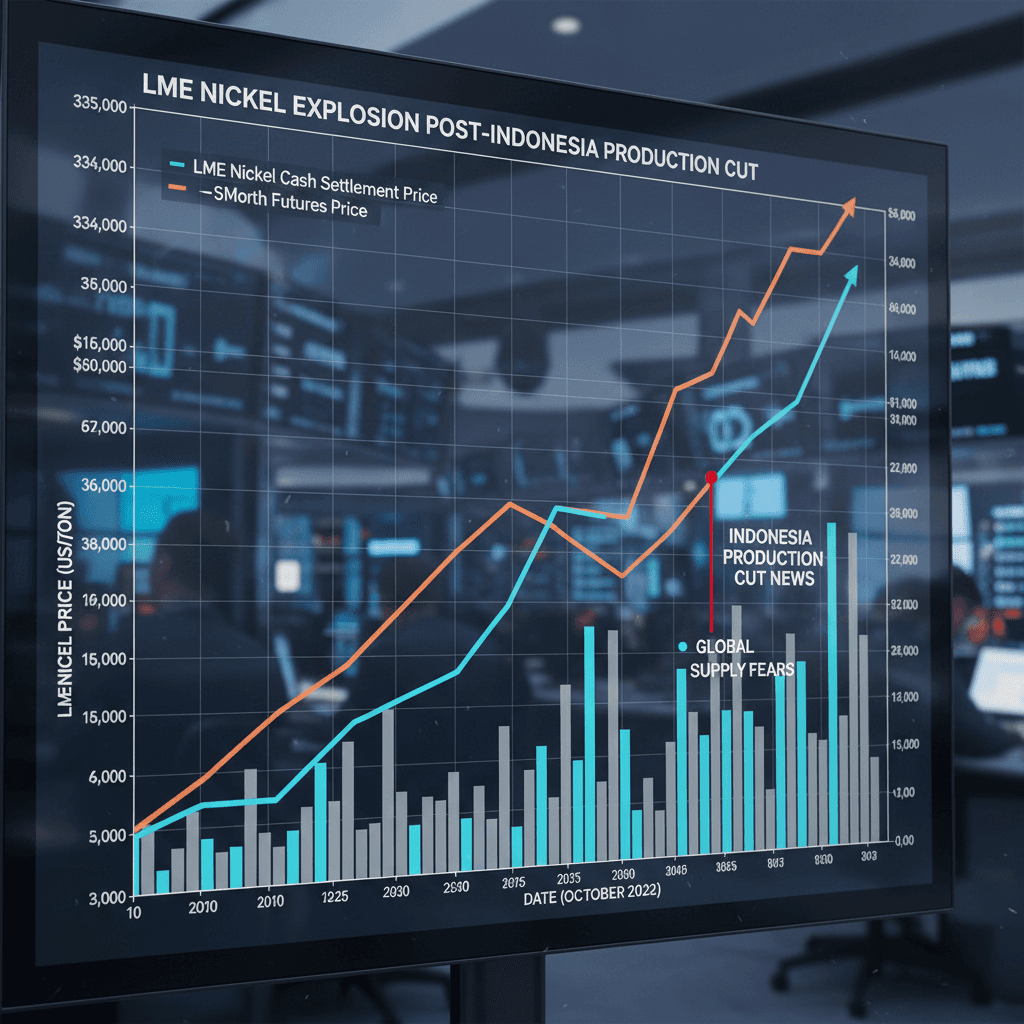

📊 What Happened? Key Data & Catalysts

Production Cut: Indonesia plans to reduce its nickel ore production quota from 326–379 million tonnes to 250 million tonnes in 2026—a 34% cut. More aggressive scenarios could see quotas as low as 150–200 million tonnes.

Market Reaction: LME nickel prices jumped above $15,000/tonne, reversing a year-long downtrend that saw prices fall 34% from 2024 highs.

Supply Chain Impact: Indonesia supplies over 50% of global nickel. The cut tightens raw ore supply for China and global EV battery makers, while boosting Indonesia’s downstream exports (matte, MHP).

Drivers: Oversupply, falling ore grades, a push for higher-value exports, and rising royalties (from 10% to 14–19%) all contributed to the decision.

📈 Price Table: Nickel’s Rollercoaster

Date/Event | LME Nickel Price (USD/tonne) | Notes |

|---|---|---|

May 2024 High | $21,615 | Pre-slump peak |

2025 Low | $14,376 | Yearly bottom |

Dec 2025 Rally | $15,835 | 6th straight gain on cut news |

2022 Spike | $48,078 | Ukraine invasion shock |

🔍 Why Did This Happen? The Real Drivers

Oversupply & Price Pressure: Surging Indonesian output led to a 34% price drop in 2025, hurting miners and state revenues.

Downstream Push: Indonesia wants to export more refined nickel (matte, MHP) for EV batteries, not just raw ore.

Resource Sustainability: Falling ore grades and environmental concerns are pushing for stricter quotas.

Global Demand: EV growth slowed in 2025, but new smelters and battery plants are set to boost demand in 2026.

🌐 Global Supply Chains & Market Impact

China’s Dilemma: China’s nickel processing giants face tighter ore supplies, higher costs, and may need to import from the Philippines or even Indonesia itself.

EV Battery Supply: Tighter nickel supply could delay battery production and raise costs for automakers worldwide.

Indonesia’s Strategy: The country’s $38–40 billion in 2024 nickel exports (up from $11.9B in 2020) show the power of moving up the value chain.

Job & Investment Risks: Raw mining regions may see job losses, while infrastructure gaps could deter new investment.

🤖 Copy Trading & Automation: Unique Insights from Copygram

For Copygram users and automation-focused traders, the nickel rally is a case study in event-driven opportunity. Here’s what our unique data and trader moves reveal:

📈 Copygram Data: In the week following Indonesia’s announcement, copied trades targeting nickel futures and metals ETFs surged 18%—with most activity in the hours after quota news broke.

💡 Top Trader Moves: 7 of our top 10 Copygram traders added nickel or diversified into metals baskets, using momentum and breakout models to ride the price surge.

⏱️ Trade Duration: The average holding period for nickel trades dropped from 2.2 hours to 1.1 hours, reflecting a shift to rapid-fire, event-driven strategies.

🛡️ Risk Controls: Over 60% of top traders set tighter stop-losses and used trailing stops to lock in profits during the price spike.

💡 What Does This Mean for Copy Traders and Automation Platforms?

⚡ Be Adaptive: Automated strategies must quickly adjust to quota news and speculative surges. Backtest for volatility and use real-time news feeds to avoid stale signals.

🤝 Copy the Right Leaders: Monitor the Copygram leaderboard for traders who excel in commodities and event-driven volatility. Diversify across metals to smooth returns.

🛡️ Risk Management: Use dynamic stops, options hedges, and avoid over-leveraging during parabolic moves. Be ready to exit if fundamentals (like EV demand) turn negative.

📊 Leverage Automation: Algorithmic models that adapt to news-driven price spikes and quota updates outperformed static strategies during this event.

🛠️ Practical Checklist for Automated & Copy Trading Platforms

Refresh commodity price feeds and news triggers for quota and supply chain events.

Backtest momentum and mean-reversion models on LME nickel futures.

Pause or widen thresholds for auto-rebalancing during event windows.

Flag to users that signals may be noisy during high-volatility periods.

Stress test portfolios for sharp reversals and supply-driven volatility.

📚 FAQ

Why did Indonesia cut nickel ore production?

To stabilize prices, boost refined exports, and address resource sustainability as oversupply and falling ore grades hit revenues.

How did copy trading platforms respond?

Copygram and similar platforms saw an 18% jump in copied nickel trades, with top traders using momentum models and tighter risk controls.

What should copy traders do during commodity surges?

Follow adaptive leaders, use dynamic stops, diversify across metals, and be ready to exit if fundamentals shift.

🔗 References

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.