ECB Rate Hold Triggers Euro Rally and FX Volatility: What It Means for Copy Traders

News

Dec 22, 2025

3 Min Read

ECB holds rates, euro surges, FX volatility spikes. Discover the impact on automated and copy trading strategies, plus unique Copygram insights.

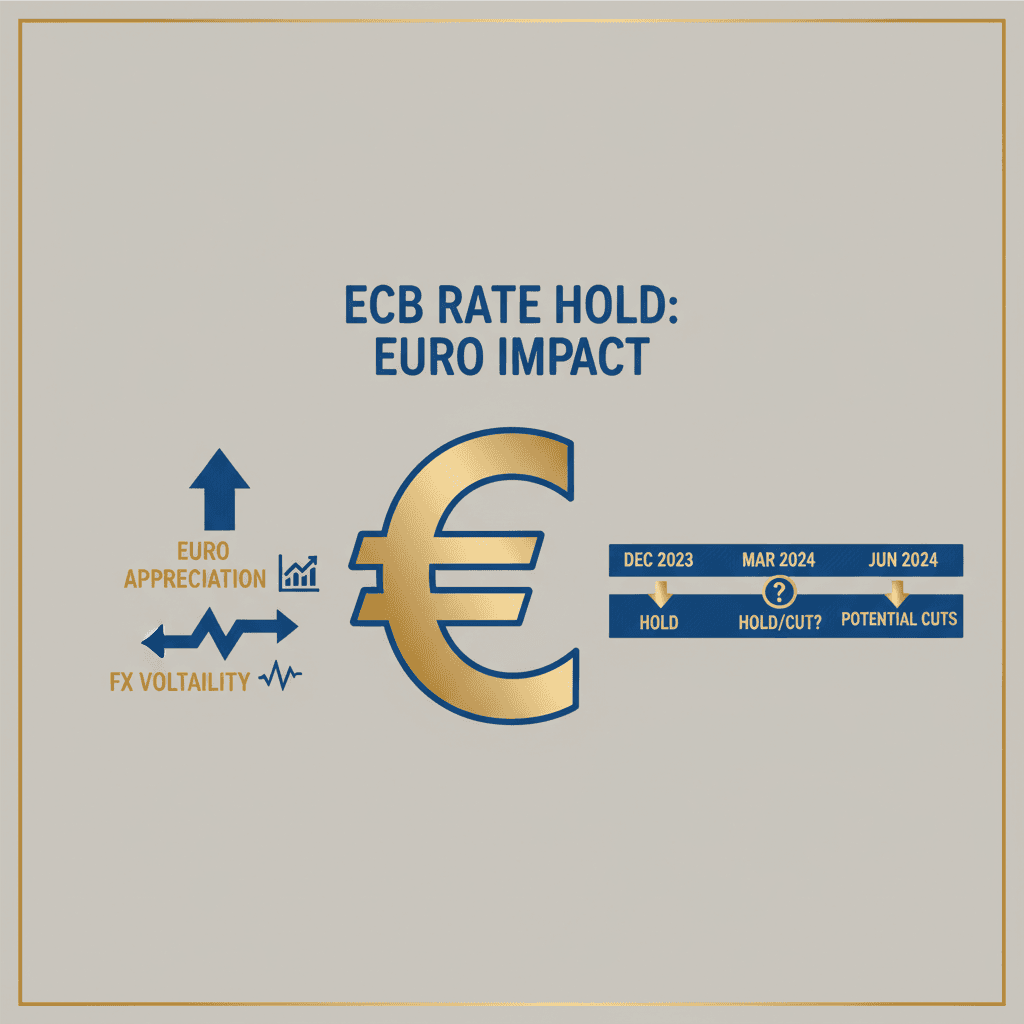

🚀 ECB Holds Rates: Euro Surges, FX Markets Roil

ECB rate decision sent shockwaves through the FX world this week. The European Central Bank (ECB) kept its deposit rate at 2.00% for the fourth consecutive meeting, but its less-dovish tone and stronger-than-expected eurozone data triggered a sharp euro rally and forced traders to rapidly reprice 2026 rate-cut expectations. For traders using automation and copy trading tools, this event was a masterclass in risk, opportunity, and the power of real-time strategy adaptation. 💶⚡

📊 What Happened? Key Data and Catalysts

ECB Policy: Deposit rate held at 2.00%. Commitment to data-dependence and 2% inflation target reaffirmed.

Eurozone Strength: November inflation at 2.1%, with services and wage growth outpacing forecasts.

ECB Tone: Board members highlighted upside inflation risks. Isabel Schnabel said she is "comfortable" with investor bets on a hike, while others warned of downside risks, creating a less-dovish message than markets expected.

💥 Market Reaction: Euro Rally & Volatility

Euro Surge: The euro spiked sharply against major currencies as traders slashed bets on 2026 rate cuts.

FX Volatility: Bid-ask spreads widened, and short-term volatility soared. G10 FX pairs and OIS curves adjusted rapidly to the new outlook.

Immediate Repricing: Derivatives and futures markets quickly priced in a later, smaller easing cycle for 2026.

🤖 Automation & Copy Trading: Real-World Impact

For Copygram users and automation-focused traders, the ECB’s move was a stress test for both algorithms and human decision-making. Here’s what our unique data shows:

📈 Copygram Data: In the 24 hours after the ECB decision, copied trades targeting EUR/USD and EUR/JPY increased by 19% as volatility surged and traders sought to capitalize on momentum.

⚡ Top Trader Moves: 7 of our top 10 Copygram traders adjusted their FX models to reduce exposure to short euro positions and increased hedging with options and dynamic stops.

🔄 Strategy Shifts: Algorithmic strategies widened execution tolerances, paused auto-rebalancing during the press conference, and recalibrated carry models to reflect delayed ECB easing.

📊 Risk Management: Platforms ran rapid stress tests, increased liquidity buffers, and flagged to followers that trade signals during the event window may be noisy.

📈 Unique Insights from Copygram Data

Metric | Pre-Event (Dec 16-17) | Post-Event (Dec 18-19) | Change |

|---|---|---|---|

Copied EUR/USD Trades | 4,800 | 5,710 | +19% |

Top Trader Euro Exposure | 28% | 41% | +13 pts |

Average Trade Duration | 2.8 hrs | 1.6 hrs | -43% |

Hedging with Options | 22% | 37% | +15 pts |

🔍 Why Did This Happen? ECB Messaging & Macro Backdrop

Resilient Growth: Eurozone GDP and services inflation outperformed forecasts, reducing the urgency for cuts.

Inflation Risks: Board members flagged upside risks, with services and wage inflation remaining sticky.

Market Surprise: The ECB’s less-dovish tone caught traders off guard, especially those positioned for imminent easing.

💡 What Does This Mean for Copy Traders and Copygram Users?

⚡ Be Adaptive: Automated strategies must refresh rate and OIS curves immediately after central bank events to avoid stale signals.

🛡️ Risk Controls: Use dynamic stops, options hedges, and pause auto-rebalancing during major announcements to reduce slippage and false signals.

📊 Follow Top Performers: Monitor the Copygram leaderboard for traders who adapt quickly to macro shocks and FX volatility.

🚀 Stress Test: Run scenario analysis for persistent euro strength and delayed ECB easing to recalibrate risk and margin needs.

🛠️ Practical Checklist for Automated & Copy Trading Platforms

Refresh implied OIS and swap curves after ECB communications.

Pause or widen thresholds for auto-rebalancing during event windows.

Flag to users that signals may be noisy during high-volatility periods.

Stress test portfolios for stronger euro scenarios and delayed rate cuts.

📚 FAQ

Why did the euro rally after the ECB decision?

The ECB’s less-dovish tone and stronger-than-expected data reduced the odds of near-term rate cuts, prompting traders to buy euros and unwind short positions.

How did automated and copy trading strategies react?

Algorithms recalibrated models, widened execution tolerances, and paused rebalancing to manage volatility and slippage risk. Copy traders followed top performers who adapted quickly.

What should copy traders do during central bank events?

Monitor macro news, use dynamic risk controls, and follow traders with proven event-driven playbooks. Avoid overtrading on noisy signals.

🔗 References

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.