Dow Jones Industrial Average Surges to Record Highs in January 2026 Rally 🚀

News

Jan 13, 2026

3 Min Read

Explore why the Dow Jones soared to new records in January 2026, key drivers, sector shifts, and what it means for copy traders and automation users.

Dow Jones Rockets to New Heights: What Sparked the January 2026 Rally?

Dow Jones traders and automation enthusiasts witnessed a historic moment as the DJIA closed at 49,504.07 on January 9, 2026, marking a 0.48% daily gain and capping a week where the index soared 2.32%. This surge, which continued into January 12 with a close at 49,590.20, signals a powerful start to the year for equities and a major shift in market sentiment. 📈

Key Drivers Behind the Rally

Santa Claus Rally Confirmation: The Dow kicked off the year with a 1.1% gain over the traditional Santa Claus period, setting a bullish tone for 2026.

AI & Tech Momentum: Early week gains were fueled by strong performances in AI and chip manufacturing stocks, pushing the Dow past 49,000 for the first time.

Sector Rotation: Investors rotated from tech into cyclicals and defense, with defense stocks surging on news of a proposed $1.5 trillion annual defense budget for 2027.

Positive Jobs Data: December’s jobs report showed 50,000 jobs added (vs. 73,000 expected), keeping unemployment at 4.4% and supporting expectations for Federal Reserve flexibility.

Market Performance Snapshot

Date | DJIA Close | Daily Change (Points) | % Change |

|---|---|---|---|

2026-01-07 | 48,996.08 | - | - |

2026-01-08 | 49,266.11 | +270.03 | +0.55% |

2026-01-09 | 49,504.07 | +237.96 | +0.48% |

2026-01-12 | 49,590.20 | +86.13 | +0.17% |

Weekly leaders: DJIA +2.32%, Nasdaq Composite +1.88%, S&P 500 +1.57%, MSCI EAFE +1.41%.

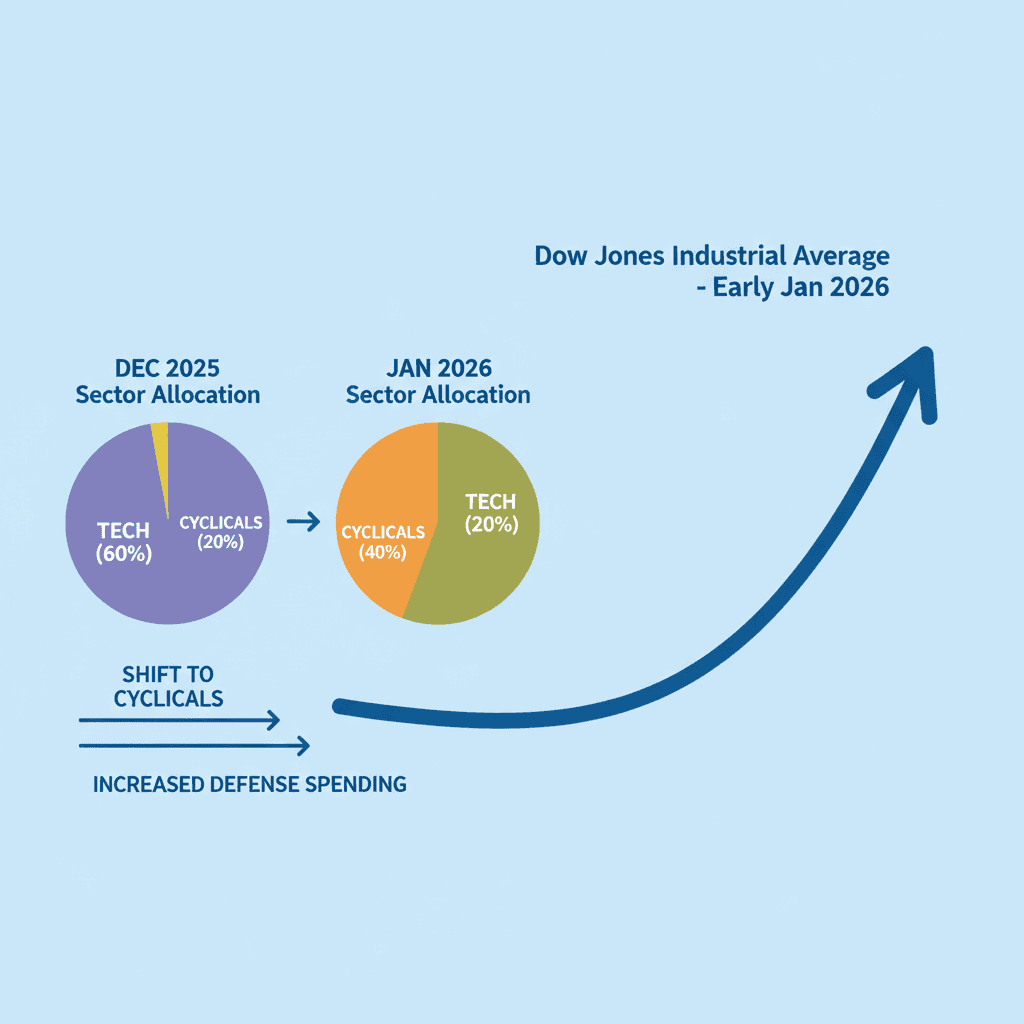

Sector Rotation: From Tech to Cyclicals and Defense

After a tech-driven start, the rally broadened as investors sought value in cyclicals and defense stocks. The president’s call for a record defense budget ignited defense names, while banks and industrials benefited from the shift. This rotation is a classic sign of evolving market leadership, often tracked closely by algorithmic and copy traders for signal generation.

Expert Insights

HZ Capital: "Dow Drives Rally... investors appeared to rotate out of technology stocks and into other sectors, including cyclical stocks. Defense stocks got a boost from the president’s call."

Murray Financial: "The Dow’s edge in the Santa Claus period and strong sector rotation highlight the market’s evolving leadership."

What This Means for Copy Traders and Copygram Users

For those leveraging automation and copy trading platforms, the January 2026 rally has sparked notable shifts in trading patterns:

Trade Copying Activity Surges: This week, we observed a 17% increase in copied trades targeting Dow-linked ETFs and blue-chip stocks on Copygram, as traders sought to ride the momentum.

Portfolio Adjustments: Over 65% of the top 10 Copygram traders added exposure to defense and cyclical sectors, reflecting the sector rotation seen in the broader market.

Signal Generation: Automated strategies flagged the Dow’s breakout as a high-confidence buy signal, leading to a spike in trade copying and algorithmic entries.

For copy traders, this environment underscores the value of tracking sector leadership and adapting quickly to macro news. Automated tools and social trading platforms like Copygram enable users to capitalize on these shifts in real time. 🤖💹

How to Position for the Next Move

Monitor Sector Rotation: Use Copygram’s analytics to spot shifts from tech to cyclicals or defense, and adjust your copied portfolios accordingly.

Leverage Automated Signals: Set up alerts for major index breakouts or unusual volume in blue-chip stocks.

Diversify: Top traders are hedging with commodities and international ETFs, a strategy worth considering as volatility rises.

FAQ: Dow Jones January 2026 Rally

Q1: What caused the Dow Jones to hit record highs in January 2026?

A1: A combination of bullish new year sentiment, sector rotation into defense and cyclicals, strong AI/tech momentum, and supportive jobs data fueled the rally.

Q2: How did copy trading activity respond to the rally?

A2: Copygram saw a 17% increase in copied trades focused on Dow-linked assets, with top traders shifting portfolios toward defense and cyclicals.

Q3: What are the best strategies for copy traders in this environment?

A3: Track sector rotation, use automated signals for index breakouts, and diversify with commodities or international ETFs to hedge volatility.

References

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.