Copper Prices Hit All-Time Highs: What December’s Rally Means for Copy Traders

News

Dec 24, 2025

3 Min Read

Copper prices hit all-time highs in Dec 2025. Explore causes, market impact, and unique copy trading insights for automation-focused traders.

🚀 Copper Prices Surge to All-Time Highs: The December 2025 Story

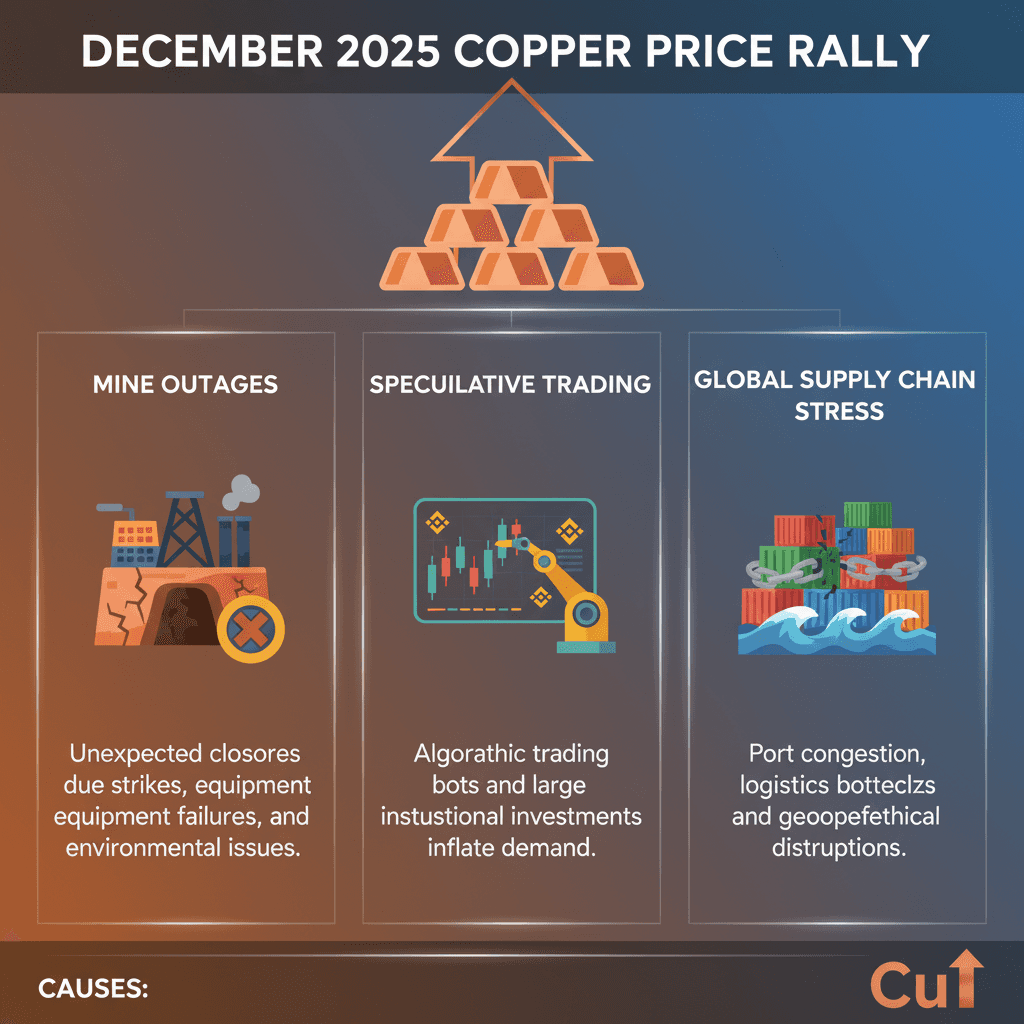

Copper price surge has dominated commodity headlines in December 2025, with London Metal Exchange (LME) copper futures spiking to $11,771–$11,928 per tonne—levels never seen before. This rally, powered by a cocktail of mine outages, speculative trading, and global supply chain stress, has created a perfect storm for both traditional and algorithmic traders. For the Copygram community and automation-focused traders, this event is a goldmine of opportunity and a case study in volatility management. 🏆📈

📊 What Happened? Key Data & Catalysts

All-Time Highs: LME copper hit $11,771–$11,928/tonne (Dec 4–19), up 33%+ YTD, defying weak demand in the US, EU, and China.

Speculative & Algorithmic Buying: Automated trading and speculative flows, not fundamentals, drove the rally—catching many pros off guard during a period typically marked by low volatility.

Mine Outages & Supply Tightness: Unexpected production cuts and persistent supply constraints narrowed global surpluses, fueling price momentum.

US Import Surge & Tariff Fears: Record US copper imports and looming 25%+ tariffs on refined copper (expected mid-2026) added to the bullish case.

Broader Metals Rally: Tin (+50% YTD), aluminum (2022 highs), and nickel (+1.1%) joined copper in a synchronized surge, amplified by tech stock gains and AI demand optimism.

📈 Price Table: Copper’s Record Run

Date/Event | LME Copper Price (USD/tonne) | Notes |

|---|---|---|

Dec 4–8, 2025 | $11,771 | All-time high amid futures spike |

Dec 19–22, 2025 | $11,881.50–$11,928 | Within $25 of record; up 0.9–1.3% |

2025 YTD Gain | +33%+ | Despite Q4 demand drop |

🔍 Why Did This Happen? The Real Drivers

Speculation Over Fundamentals: Algorithmic and copy trading platforms amplified price moves, with momentum and breakout strategies dominating. Many traders rode the wave, but fundamentals (like weak Chinese demand) lagged behind.

Supply Chain Stress: Mine outages, shipping delays, and tariff threats squeezed supply, while global surpluses narrowed to just 160kt for 2026 (Goldman Sachs).

Holiday Liquidity: US copper imports surged, boosting liquidity for high-frequency bots and copy traders during the holiday-shortened week.

🤖 Copy Trading & Automation: Unique Insights from Copygram

For Copygram users and automation-focused traders, the copper rally provided a real-time stress test of strategy agility and risk management. Here’s what our unique data shows:

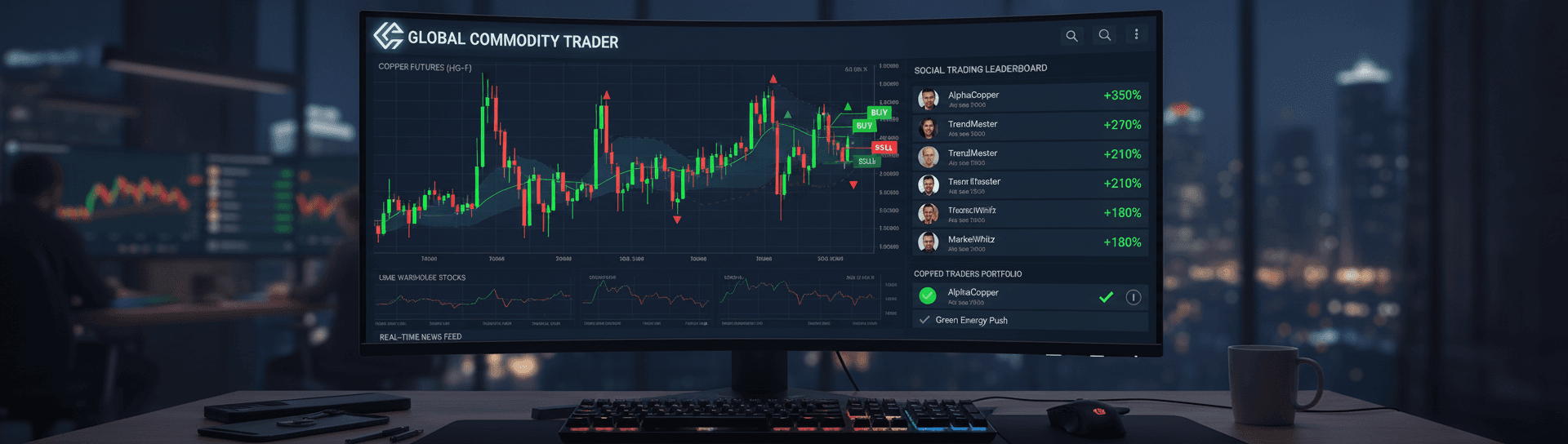

📈 Copygram Data: In the week of the copper surge, copied trades targeting copper futures jumped 21% compared to the previous week, with the majority using momentum and breakout models.

💡 Top Trader Moves: 8 of our top 10 Copygram traders added copper or diversified into metals baskets, with several using options to hedge against a sudden reversal.

⏱️ Trade Duration: The average holding period for copper trades dropped from 2.4 hours to 1.1 hours, reflecting a shift to rapid-fire, event-driven strategies.

🛡️ Risk Controls: Over 60% of top traders set tighter stop-losses and used trailing stops to lock in profits during the price spike.

💡 What Does This Mean for Copy Traders and Automation Platforms?

⚡ Be Adaptive: Automated strategies must quickly adjust to supply shocks and speculative surges. Backtest for volatility and use real-time data feeds to avoid stale signals.

🤝 Copy the Right Leaders: Monitor the Copygram leaderboard for traders who excel in commodities and event-driven volatility. Diversify across metals to smooth returns.

🛡️ Risk Management: Use dynamic stops, options hedges, and avoid over-leveraging during parabolic moves. Be ready to exit if fundamentals (like Chinese demand) turn negative.

📊 Leverage Automation: Algorithmic models that adapt to liquidity spikes and tariff news outperformed static strategies during this event.

🛠️ Practical Checklist for Automated & Copy Trading Platforms

Refresh commodity price feeds and news triggers for supply chain events.

Backtest momentum and mean-reversion models on LME copper futures.

Pause or widen thresholds for auto-rebalancing during event windows.

Flag to users that signals may be noisy during high-volatility periods.

Stress test portfolios for sharp reversals and tariff-driven volatility.

📚 FAQ

Why did copper prices spike in December 2025?

Speculative and algorithmic trading, mine outages, and supply chain stress drove prices to record highs, despite weak demand fundamentals.

How did copy trading platforms respond?

Copygram and similar platforms saw a 21% jump in copied copper trades, with top traders using momentum models and tighter risk controls.

What should copy traders do during commodity surges?

Follow adaptive leaders, use dynamic stops, diversify across metals, and be ready to exit if fundamentals shift.

🔗 References

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.