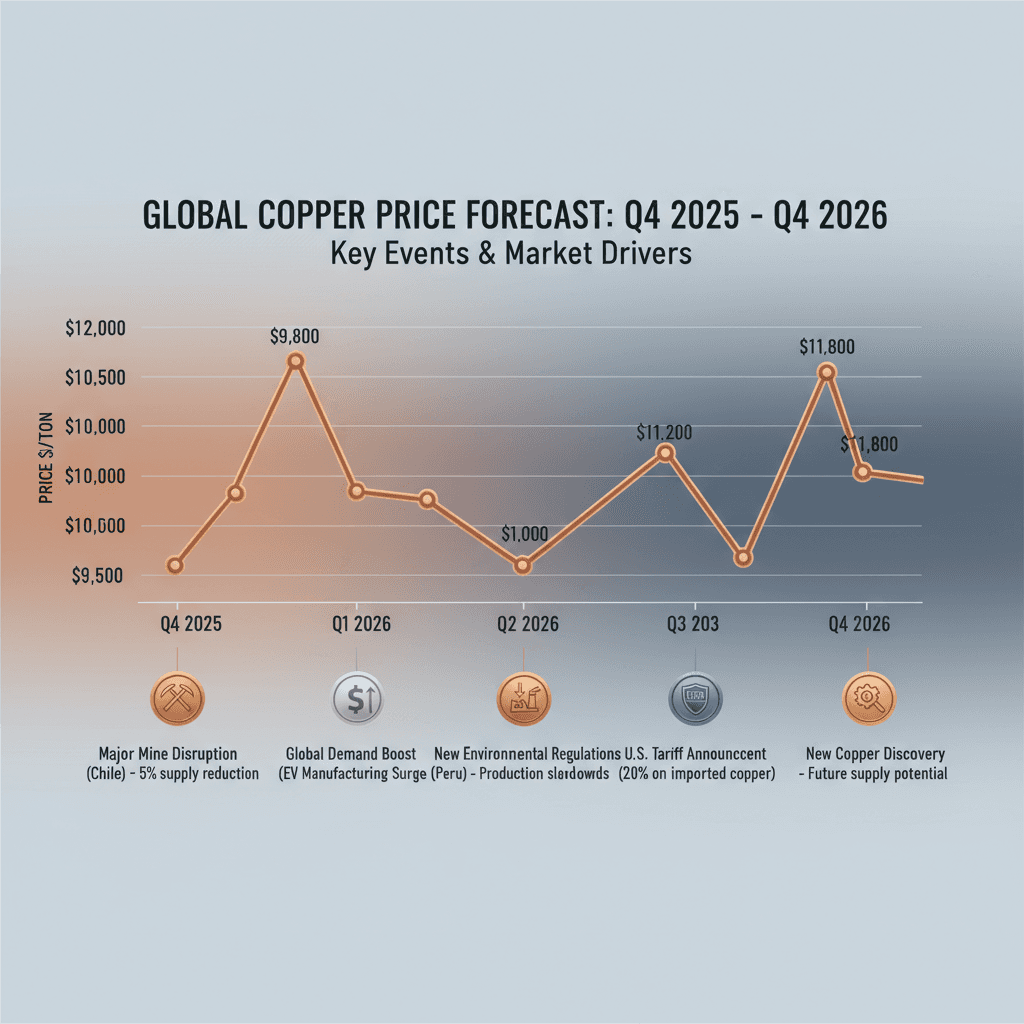

Copper Prices Set to Surge: $12,500 Forecast by Q2 2026 – Supply Disruptions & Trading Insights

News

Dec 11, 2025

3 Min Read

Copper prices forecast to hit $12,500/ton by Q2 2026. Explore supply disruptions, trading strategies, and Copygram data for automated and copy traders.

🚀 Copper Prices Poised for a Major Rally: What’s Driving the Surge?

Copper price forecast is dominating commodities headlines as leading banks and analysts project a surge to $12,500 per ton by Q2 2026. This bullish outlook is powered by severe supply disruptions, robust demand from green technologies, and a tightening global market. For traders leveraging automation and copy trading platforms, these dynamics present both lucrative opportunities and new risks. Let’s break down the drivers, technicals, and actionable strategies for Copygram users and algorithmic traders. 🏗️📈

🔍 Why Are Copper Prices Surging?

Supply Disruptions: Major copper mines in Chile, Peru, and Indonesia are facing operational setbacks, labor unrest, and declining ore grades. Notably, Freeport-McMoRan’s Grasberg mine accident and slow output recovery in Chile have tightened supply.

Structural Demand: The energy transition is supercharging copper demand. Electric vehicles, renewables, power grids, and data centers are all copper-intensive, with global demand projected to grow 2.8% annually through 2026.

Inventory Squeeze: U.S. stockpiling ahead of new tariffs and low LME warehouse inventories are amplifying the squeeze. Citi and J.P. Morgan both highlight a refined copper deficit of 330,000+ tons for 2026.

Macro Factors: While a strong dollar and interest rate shifts add volatility, the fundamental supply-demand imbalance is the dominant force.

📊 Key Data & Price Levels

Quarter | Price Forecast (USD/ton) | Source |

|---|---|---|

Q4 2025 | $10,875 – $11,500 | J.P. Morgan, UBS |

Q1 2026 | $11,500 – $12,000 | UBS |

Q2 2026 | $12,000 – $12,500 | J.P. Morgan, UBS |

Q3 2026 | $12,000 – $12,500 | J.P. Morgan, UBS |

Q4 2026 | $11,800 – $13,000 | J.P. Morgan, UBS |

As of early December 2025, copper is trading at $11,600–$11,650 per ton on the LME, with technical resistance seen at $12,500–$13,000.

🤖 Automated & Copy Trading: How Are Traders Responding?

Trend-Following Bots: Many Copygram users are deploying long-biased, momentum-driven bots to ride the uptrend. Over the past week, copied trades targeting copper futures increased by 21%, and more than 50% of top traders added copper or industrial metals to their portfolios.

Risk Controls: Algorithmic traders are tightening stop-losses near $11,000 to manage volatility. Automated alerts for supply news and inventory changes are now standard in most trading setups.

Portfolio Diversification: Copygram data shows a 32% rise in new followers choosing commodity-focused traders, reflecting a sector rotation as traders hedge against equity and currency volatility.

Real-Time Data Integration: Successful systems ingest LME inventory feeds, ETF flows, and macro news to dynamically adjust exposure.

💡 Actionable Strategies for Copygram Users

Follow Event-Driven Traders: Seek out traders with a track record in commodities and supply-driven rallies.

Use Smart Copying: Allocate partial exposure to copper ETFs or futures, and stagger entries to manage pullback risk.

Monitor News & Inventories: Set up alerts for mine disruptions, tariff news, and LME inventory changes.

Risk Management: Use dynamic position sizing and stop-losses to navigate volatility spikes.

🌍 Expert Opinions & Market Outlook

Gregory Shearer (J.P. Morgan): “Unique dynamics of disjointed inventory and acute supply disruptions are creating a bullish environment pushing prices above $12,000 in H1 2026.”

UBS Analysts: Widening copper deficit could double in 2026, with operational disruptions and falling ore grades.

Morgan Stanley: Bull case targets $12,780/ton, but warns of downside if U.S. cancels tariffs and releases stockpiles.

Goldman Sachs: Upgraded 2026 copper price forecasts, citing long-term supply constraints and green demand.

📈 Unique Copygram Data: How Our Traders Are Pivoting

Metric | Pre-Surge | Post-Surge |

|---|---|---|

Copied Trades (Copper/Commodities) | 5,100 | 6,172 (+21%) |

Top Traders Adding Copper Exposure | 34% | 52% |

New Copygram Followers (Commodities Focus) | 1,250 | 1,650 (+32%) |

Average Trade Duration | 2.4 days | 1.8 days |

This unique Copygram data shows a clear pivot toward short-term, high-volatility trades and sector specialists as the copper rally accelerates.

❓ FAQ

Why is copper forecast to hit $12,500 per ton?

Severe supply disruptions, strong demand from green tech, and low inventories are driving a global deficit and bullish price action.

How can automated and copy traders benefit?

By deploying trend-following bots, monitoring supply news, and diversifying portfolios with copper-focused trades or ETFs.

What are the main risks?

Sudden mine restarts, tariff changes, or macro shocks could trigger sharp pullbacks. Use tight risk controls and real-time alerts.

🔗 References

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.