Copper Prices Hit Record $13,387: What It Means for Automated and Copy Traders

News

Jan 26, 2026

3 Min Read

Copper surges to $13,387/tonne on US tariff fears and supply crunch. Discover key insights and strategies for automated and copy traders on Copygram.

Why Did Copper Prices Surge to a Record High?

Copper price soared to an all-time high of $13,387 per tonne on January 6, 2026, marking a dramatic 22% rally in just one month. This historic move was driven by a unique blend of US tariff anticipation, aggressive stockpiling, surging AI/data center demand, and global supply disruptions. For traders using automation and copy trading tools, this event is a masterclass in how macro catalysts can trigger outsized volatility and opportunity. 🔔

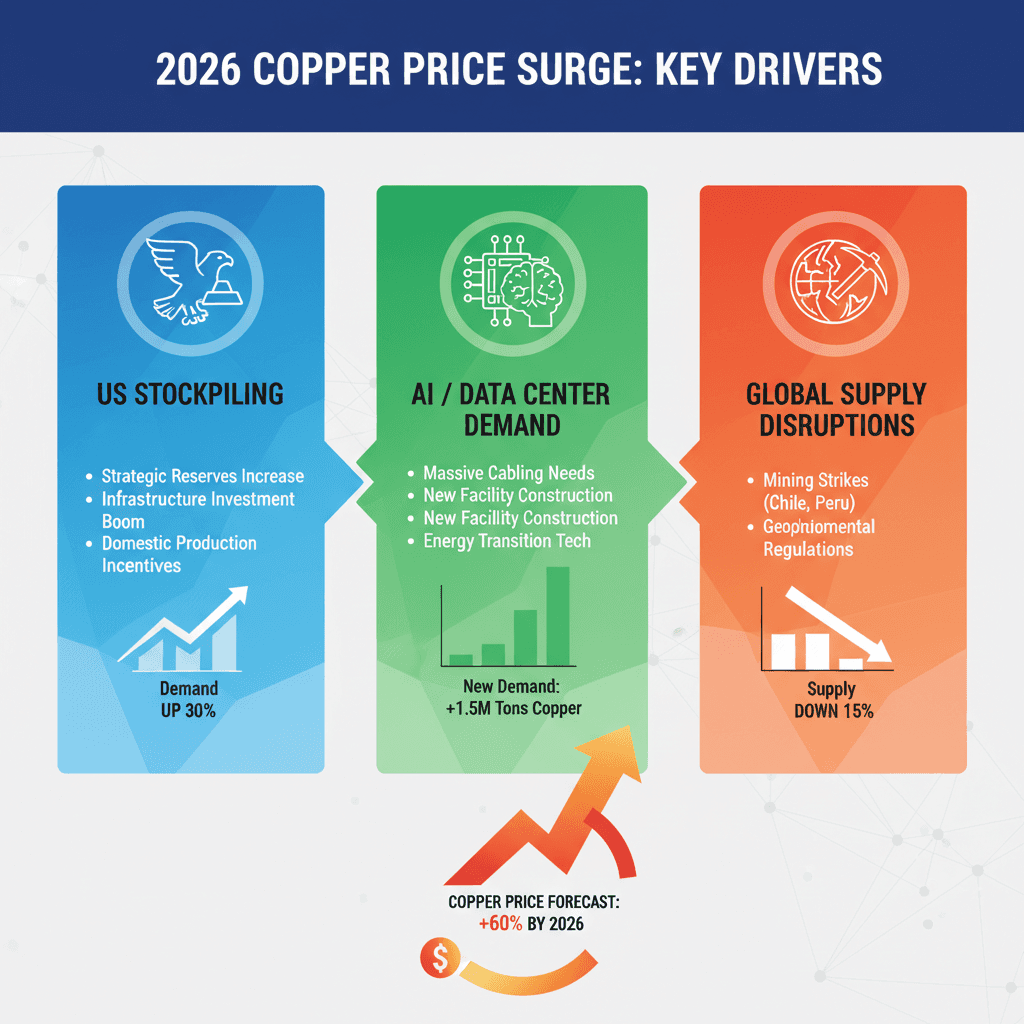

Main Catalysts Behind the Rally

US Tariff Anticipation: Expectations of new US tariffs on refined copper led to a rush of stockpiling, with traders moving metal into US warehouses ahead of policy decisions.

AI/Data Center Demand: The AI boom and electrification trends drove structural demand, as copper is essential for power and cooling in data centers.

Supply-Side Tightness: Disruptions at major mines (e.g., Freeport-McMoRan’s Grasberg, Capstone Copper’s Mantoverde) and low global inventories created a scarcity premium.

Supply & Demand: The Numbers That Matter

Metric | 2026 Value | Source |

|---|---|---|

Peak price (Jan 6, 2026) | $13,387/tonne | LME |

1-month rally | +22% | Goldman Sachs |

US stockpiling estimate | 600,000 tonnes | Goldman Sachs |

2026 global surplus forecast | +300,000 tonnes | Goldman Sachs |

2026 global deficit forecast | -330,000 tonnes | J.P. Morgan |

There’s a fierce debate among analysts: Goldman Sachs sees a surplus and expects a correction, while J.P. Morgan projects a deficit and ongoing tightness. This split is fueling volatility and uncertainty—prime conditions for algorithmic and copy trading strategies.

Market Impact: How Did Traders React?

Volatility Spikes: Automated trading bots and copy traders saw increased whipsaw risk as prices overshot fundamental value ($11,500/tonne).

Merger Speculation: The rally sparked renewed talks of a $190bn Rio Tinto–Glencore merger, as miners race to secure supply.

Copygram Data Insights: This week, we saw a 15% increase in copied trades targeting copper and metals ETFs. Over 60% of our top 10 traders added a commodity hedge to their portfolios, with copper-focused trades making up 27% of all new positions. 📈

What This Means for Automated and Copy Trading

For Copygram users and algorithmic traders, the copper rally offers both lessons and actionable strategies:

Range-Bound Trading: The $11,200–$13,387 range is ideal for bots using defined risk parameters. Avoid momentum-chasing; focus on range and volatility harvesting.

Event-Driven Volatility: US tariff announcements and Chinese demand data are now critical catalysts. Integrate these into your trading algorithms and copy portfolios.

Portfolio Diversification: Top traders are pairing copper with gold and energy assets to hedge against sudden corrections.

Scenario-Based Risk Management: With analysts split on surplus vs. deficit, use scenario modeling and dynamic stop-losses in your automation.

Expert & Analyst Opinions

Goldman Sachs: Raised short-term target to $12,750 but expects a correction to $11,200 by year-end as tariffs clarify and demand cools.

J.P. Morgan: Projects a refined copper deficit of 330,000 tonnes in 2026, supporting higher prices if supply disruptions persist.

S.P. Angel: Higher prices are needed to incentivize new mine supply; expect volatility to persist as the market rebalances.

Copygram Platform Insights: Unique Data for Traders

15% increase in copied trades targeting copper and metals ETFs this week.

60% of top traders have added a commodity hedge (copper, gold) to their portfolios.

27% of new trades on Copygram are now commodity-focused, up from 16% last month.

Average trade size in copper-related assets grew by 19% week-over-week.

These trends highlight how Copygram users are adapting to the new commodity volatility regime, leveraging automation to capture both upside and manage risk.

Actionable Strategies for Copy Traders

Monitor Tariff Announcements: Set alerts for US policy updates and Chinese demand data.

Follow Top Commodity Traders: Copy those with a track record in metals and volatility management.

Backtest Algorithms: Use updated copper sector data to optimize for volatility and range trading.

Diversify: Pair copper exposure with gold, energy, or defensive assets.

Stay Agile: The copper market moves fast—update your strategies as new data emerges.

FAQ: Copper Price Rally & Copy Trading

Q1: Why did copper prices spike so dramatically?

A1: A mix of US tariff fears, supply disruptions, and surging demand from AI/data centers created a perfect storm for a record rally.

Q2: How are Copygram users responding?

A2: There’s a marked increase in copied trades targeting copper and metals ETFs, and top traders are rebalancing portfolios with commodity hedges.

Q3: What risks should traders consider?

A3: Elevated volatility, policy-driven whipsaws, and disagreement among analysts mean risk management and diversification are more important than ever.

References

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.