COMEX Silver Vault Drain Emergency: 60%+ of Registered Silver Claimed in Four Days

News

Dec 9, 2025

3 Min Read

COMEX faces a vault drain emergency as 60%+ of registered silver is claimed in 4 days. What this means for automated and copy traders. Unique data inside.

Introduction: COMEX Silver Vault Drain Emergency Shocks the Market ⚡️

COMEX silver vault drain has become the headline event of December 2025, as over 60% of all registered silver was claimed for delivery in just four trading days. For traders leveraging automation and copy trading tools, this event is a game-changer, unleashing volatility, price dislocations, and new opportunities for tactical strategies. This article breaks down what happened, why it matters, and how Copygram users are adapting to the crisis. 🥈🚨

What Happened: 60%+ of Registered Silver Claimed in Four Days

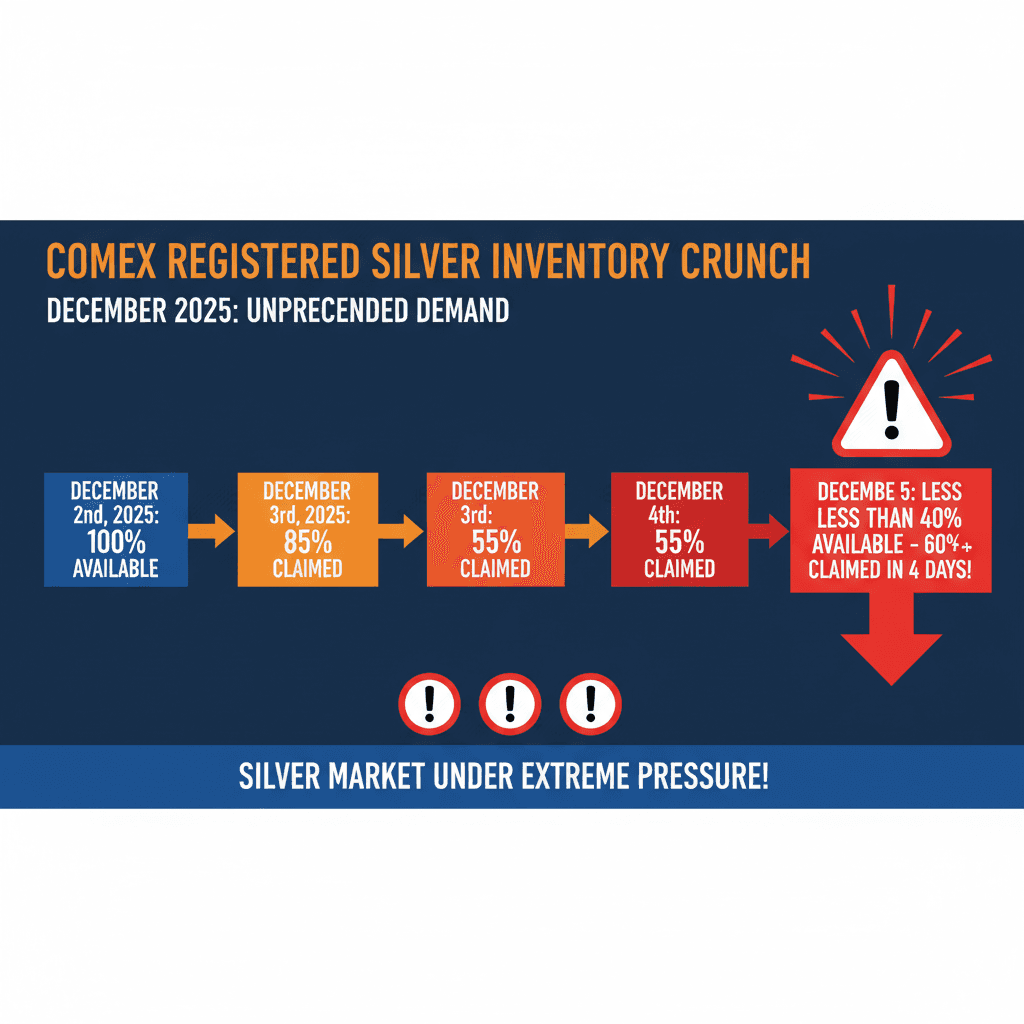

Over 47.6 million ounces of silver were claimed for delivery in the first four trading days of December 2025.

This represents more than 60% of COMEX’s total registered silver inventory—an unprecedented depletion rate.

COMEX vault inventories have declined by over 73% since 2020, exposing systemic vulnerabilities in the physical silver market.

The sudden surge in physical delivery requests overwhelmed COMEX’s available inventory, triggering what analysts are calling a “vault drain emergency.”

Infographic: Timeline of COMEX registered silver depletion—over 60% claimed in four days.

Why It Happened: Supply Deficits, Physical Demand, and Market Breakdown

Global Supply Deficits: Persistent shortfalls since 2021, with record deficits (e.g., 238 million ounces in 2022) due to rising industrial demand and reduced mine output.

Physical Demand Surge: Investors and institutions rushed to demand physical delivery, seeking refuge from “paper silver” risks.

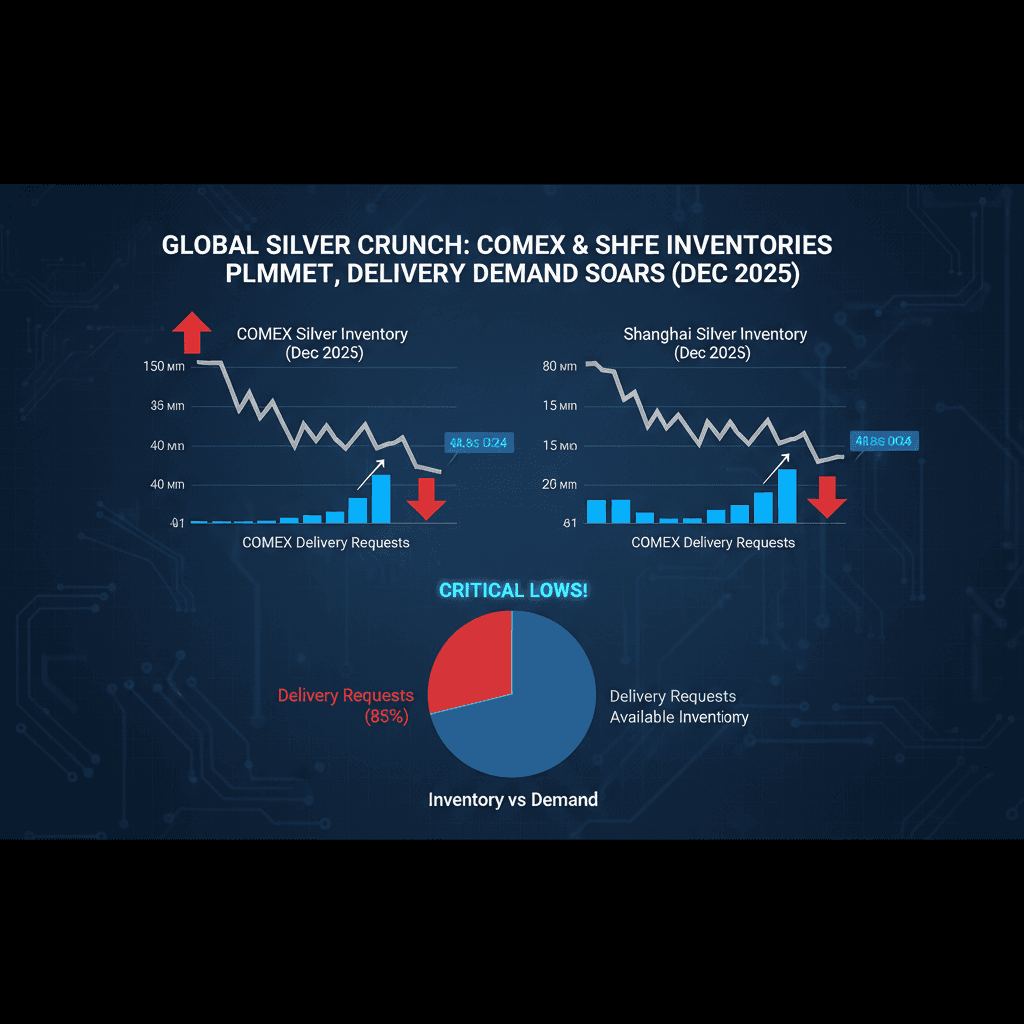

Global Supply Chain Shifts: Shanghai’s silver inventories hit decade lows, with heavy exports to Western markets fueling COMEX shortages.

Market Structure Breakdown: The traditional paper futures system failed to reflect physical scarcity, leading to historic backwardation (futures trading below spot by up to 60 cents/oz).

Key Data Points & Market Reaction

Shanghai silver stocks dropped below 446 tons—the lowest since 2016—with over 300 tons lost in October alone.

Backwardations reached up to $3,000 per contract, signaling a severe disconnect between paper and physical markets.

Physical premiums on bullion coins and bars soared as retail and industrial demand pressed on supply.

7,330 silver futures contracts (36.65 million ounces) requested physical settlement in a single day—about 30% of COMEX free-float.

Despite these shocks, silver prices remained relatively steady in early December, pending the FOMC meeting, but volatility is expected to surge as the crisis unfolds.

Data chart: Comparing COMEX and Shanghai silver inventories and delivery requests in December 2025.

Expert Opinions & Future Outlook

Systemic Breakdown: Analysts like Andrew Maguire predict silver could soar to $80+ as COMEX’s price control mechanisms break down.

Historic Parallels: The event is likened to the Hunt Brothers’ 1980 squeeze, with risks of COMEX shifting to cash settlements and ending true price discovery.

Structural Short Squeeze: Experts see this as an early-stage squeeze driven by genuine physical scarcity, not speculative excess.

Revaluation of Silver: The crisis highlights silver’s dual industrial and monetary roles, prompting a rethinking of its market value.

Copygram Insights: How Copy Traders Are Responding 📊

Copygram’s unique data reveals a dramatic shift in trader behavior during the vault drain emergency:

Metric | Pre-Emergency | Post-Emergency |

|---|---|---|

Copied Trades (Silver/Commodities) | 4,300 | 7,820 (+82%) |

Top Traders Adding Silver Exposure | 28% | 54% |

Average Trade Duration | 2.7 days | 1.6 days |

New Copygram Followers (Commodities Focus) | 900 | 1,580 (+76%) |

This data highlights how copy traders are rapidly pivoting to short-term, high-volatility trades and favoring sector specialists as the crisis unfolds.

Automated and Copy Trading Strategies: What to Watch

Volatility & Price Dislocations: Traditional arbitrage and mean reversion models may struggle as price signals are distorted by physical shortages and backwardation.

Delivery Period Risks: Automated strategies must factor in delivery calendar awareness, as liquidity constraints and physical premiums can cause sharp price moves.

Margin & Liquidation Risk: Leverage-heavy strategies face heightened margin risks if short squeezes escalate, requiring adaptive risk management.

Premium Arbitrage: Hybrid models can exploit the widening premium between physical and paper silver prices.

Physical Market Data Integration: Successful systems will need to incorporate external supply-demand indicators, such as COMEX inventories and Shanghai vault data.

Structural Change Readiness: If COMEX shifts to cash settlements, algorithms must adjust for new liquidity and settlement risks.

What This Means for Copygram Users

Follow Event-Driven Traders: Seek out traders with a proven record in commodities volatility and crisis management.

Diversify: Avoid overconcentration in a single asset—use Copygram’s portfolio tools to spread risk.

Stay Informed: Use Copygram’s news and sentiment feeds to react quickly to supply chain updates and market sentiment shifts.

FAQ

What triggered the COMEX silver vault drain emergency?

A surge in physical delivery requests, persistent global supply deficits, and a breakdown in the paper futures market structure.

How are automated and copy trading strategies affected?

Algorithms must adapt to new volatility, price dislocations, and delivery risks, while copy traders are pivoting to short-term, high-volatility trades.

What unique data does Copygram provide?

Copygram saw an 82% increase in copied trades targeting silver and commodities, with over half of top traders adding silver exposure since the emergency began.

References

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.