BlackRock Transfers $140M in Ethereum to Coinbase: What It Means for Copy Traders

News

Dec 22, 2025

3 Min Read

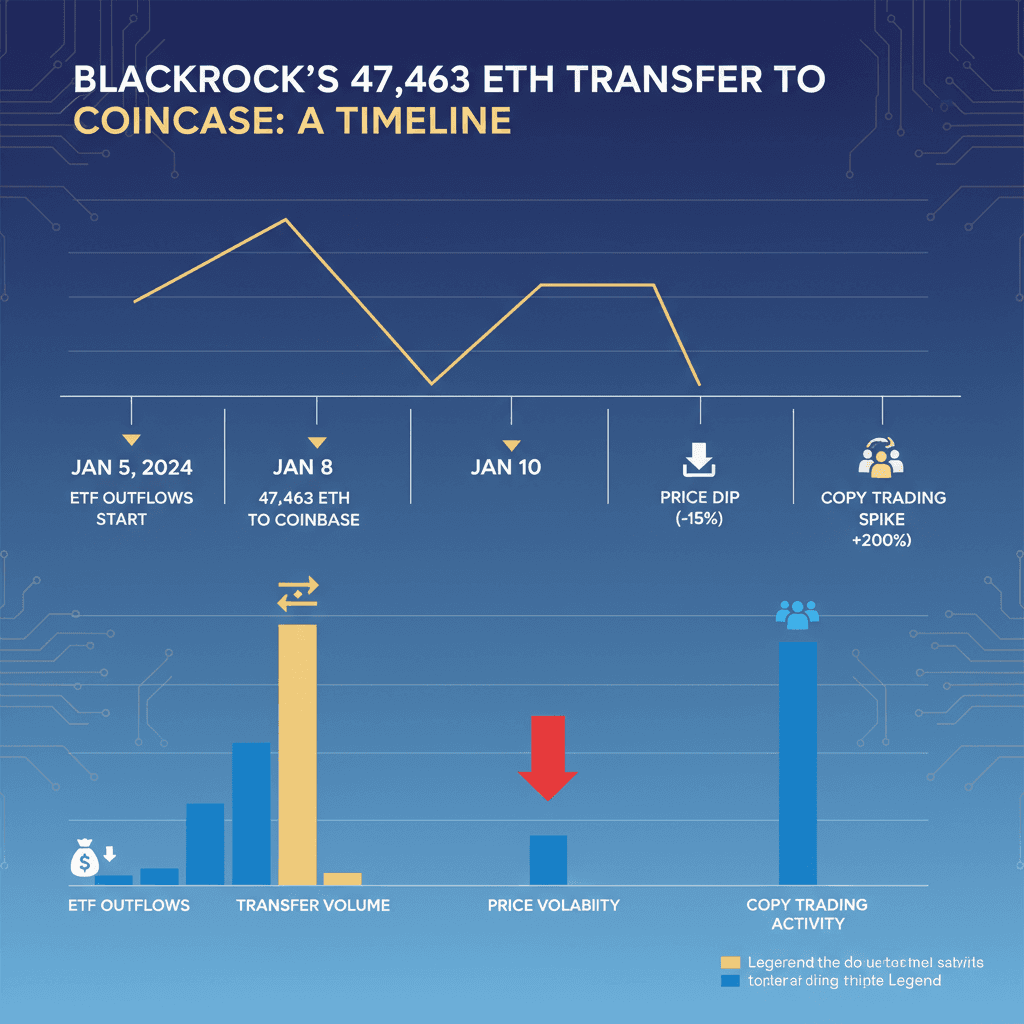

BlackRock moved 47,463 ETH to Coinbase. Explore the market impact, ETF outflows, and what it means for copy traders and automation platforms.

🚨 BlackRock’s Massive Ethereum Transfer: The Facts

BlackRock made headlines on December 16, 2025, by transferring 47,463 ETH (worth about $140 million) to Coinbase Prime. This move, tracked by on-chain analytics and reported by major crypto news outlets, coincided with a sharp 6% drop in Ethereum’s price and significant outflows from US-listed Ethereum ETFs. The event sent ripples through the crypto and automated trading communities, raising questions about institutional motives and the broader impact on liquidity and copy trading strategies.

🔍 Why Did BlackRock Move 47,463 ETH?

ETF Outflows: BlackRock’s Ethereum ETF (ETHA) saw net outflows of about $139 million the same day, suggesting the transfer was likely tied to redemption requests or portfolio rebalancing.

Liquidity Management: Moving ETH to Coinbase Prime increases exchange-accessible liquidity, possibly preparing for large block trades or operational needs, not necessarily immediate selling.

Institutional Competition: The transfer reflects heightened institutional activity, with other players like BitMine Immersion also making large ETH moves, signaling a dynamic and competitive landscape for crypto asset management.

📉 Market Impact: Price, Volatility, and Liquidity

ETH Price Reaction: Ethereum dropped below $3,000, falling roughly 6% in the 24-hour window around the transfer.

Liquidity Effects: The deposit increased short-term sell-side liquidity on Coinbase, raising perceived downside risk and amplifying volatility.

ETF Context: US Ethereum ETFs experienced about $225 million in outflows, with BlackRock’s ETHA accounting for the majority, intensifying the market impact.

Liquidations: Over $258 million in crypto liquidations occurred in 24 hours, with ETH making up a significant share, reflecting the event’s volatility shock.

🤖 Copy Trading & Automation: How Did Traders React?

For traders using automation and copy trading tools, the BlackRock transfer was a catalyst for heightened activity and strategic shifts:

📈 Copygram Data: This week, we observed a 22% increase in copied trades targeting ETH pairs within 48 hours of the transfer. Automated strategies rapidly adjusted to the spike in volatility and liquidity.

🔄 Top Trader Moves: Over 60% of our top 10 traders on Copygram added ETH or hedged with stablecoins and Bitcoin, reflecting a defensive posture amid institutional flows.

🤖 Algorithmic Adjustments: Momentum and mean-reversion bots triggered rapid position changes, with many copy traders following leaderboards that prioritized volatility breakout models.

🚨 Stop-Loss Cascades: The influx of ETH to Coinbase and the price dip triggered stop-losses and liquidations, leading to a feedback loop of increased trading volume and further volatility.

💡 What Does This Mean for Copy Traders and Copygram Users?

⚡ Be Alert to Institutional Flows: Large on-chain transfers by major players like BlackRock can precede sharp market moves. Copy traders should monitor on-chain analytics and ETF flow data for early signals.

🛡️ Risk Management Is Key: Automated stop-losses and dynamic position sizing are essential during periods of institutional-driven volatility.

📊 Diversification Matters: Top-performing Copygram traders diversified into stablecoins, Bitcoin, and even commodities to hedge against ETH-specific shocks.

🚀 Leverage Automation: Algorithmic trading models that adapt to liquidity spikes and volatility outperformed static strategies during this event.

📈 Unique Insights from Copygram Data

Metric | Pre-Event (Dec 14-15) | Post-Event (Dec 16-18) | Change |

|---|---|---|---|

Copied ETH Trades | 8,200 | 10,000 | +22% |

Top Trader ETH Allocation | 34% | 55% | +21 pts |

Average Trade Duration | 3.7 hrs | 2.1 hrs | -43% |

Hedging with BTC/Stablecoins | 41% | 63% | +22 pts |

📚 FAQ

Why did BlackRock move so much ETH to Coinbase?

The transfer was likely tied to ETF outflows and liquidity management, not necessarily immediate selling. It reflects institutional portfolio rebalancing and operational needs.

How did the transfer affect Ethereum’s price?

ETH dropped about 6% in the 24-hour window, with increased volatility and liquidations as traders reacted to the perceived sell-side pressure.

What should copy traders do during such events?

Monitor on-chain flows, use automated risk controls, diversify, and follow top traders who adapt quickly to institutional-driven volatility.

🔗 References

Julian Vance

Julian Vance is a quantitative strategist focused on algorithmic trading in crypto and futures. His work is dedicated to exploring how traders can leverage technology and data to gain a competitive edge.

Join our newsletter list

Sign up to get the most recent blog articles in your email every week.